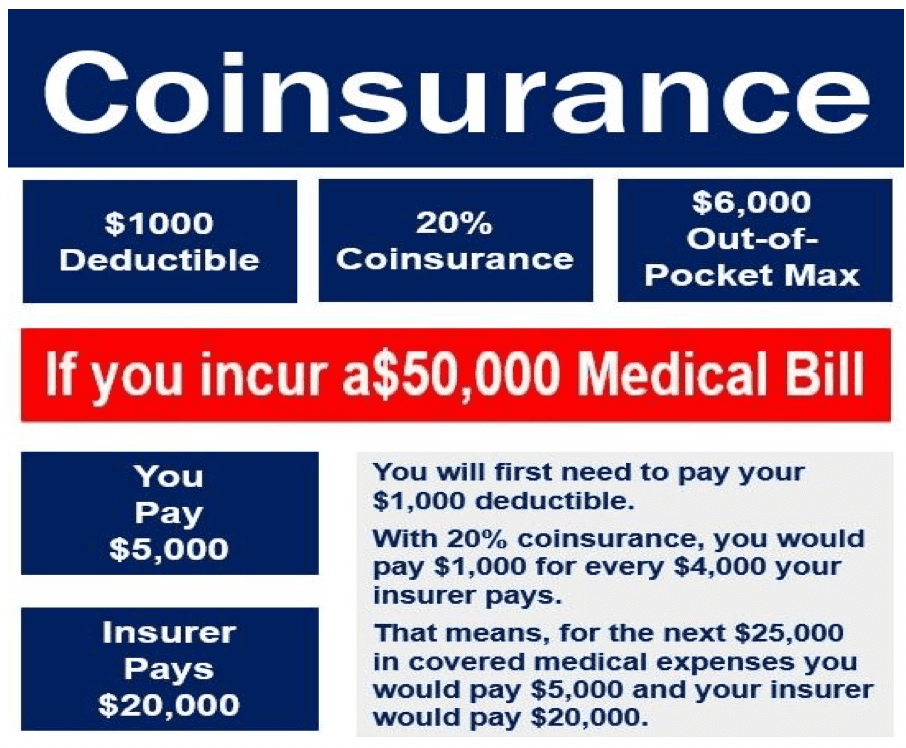

When you visit the doctor, your plan may have a set copayment amount, such as a $40 copayment for office visits, that you pay at the time of the visit. Copayment: unlike coinsurance, this is a flat rate you may pay for covered medical care, usually at the time that you get the service.So, for example, if your coinsurance is 20%, you’ll pay 20% of the total medical bill, and your health plan will pay 80%. Coinsurance: Coinsurance is a percentage amount you may owe for covered medical services and prescriptions after you’ve met your deductible.Generally, any costs that go towards meeting your deductible also go towards your out-of-pocket maximum.

Deductible: Your deductible is the amount you must spend first on eligible medical costs before insurance kicks in and starts paying its share.

Once you reach this limit, your insurance will cover 100% of eligible costs for the remainder of the year. Out-of-pocket maximum: This is the maximum amount you’ll have to pay in a calendar year for covered medical expenses.

Healthcare expenses can be categorized into several key components: Understanding healthcare costs is essential for making informed decisions about your medical care. If you have health insurance, you may have heard of the “out-of-pocket maximum.” Here’s an overview of how it works, including which costs do and don’t count towards it, and what happens after your out-of-pocket maximum is met.

0 kommentar(er)

0 kommentar(er)